You can often prevent winter damage to your home. But when you can’t, your home insurance can help.

Whether it’s tumbling temperatures or a blackout blizzard, winter weather can wreak havoc on a home. But you can avoid a disaster with some preventive action.

Here are four common types of winter-related home damage and how you can prevent them, plus how home insurance works if you can’t.

1. Burst water pipes

During the cold winter months, water pipes in your home can freeze and burst, resulting in serious property damage. Fortunately, this scenario is avoidable. The steps below show you how to prevent frozen pipes.

Prevention Tips

When the temperature plummets, pipes can freeze. Usually, your home insurance policy will cover damage that results from a burst pipe, but not always. For example, if you turned off your heat before going on vacation, and then your pipes freeze and burst, you may not be covered.

Here’s what you can do as a homeowner to prevent your pipes from freezing.

- Insulate Your Pipes

- Maintain a Steady Temperature

- Keep Faucets Running

- Open Cabinet Doors

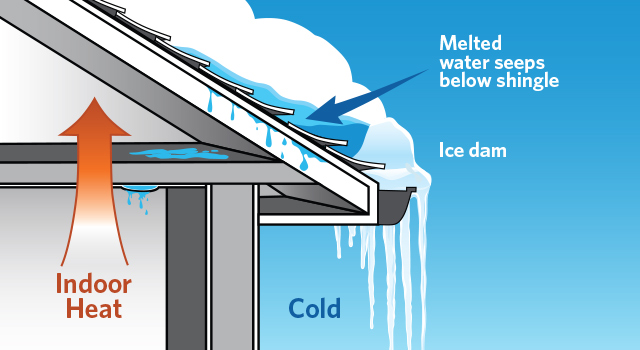

2. Ice dams on the roof

Icicles hanging from your home’s roof may look dazzling, but they can also be a sign of ice dams. And if an ice dam gets big enough, it can cause severe damage to your home. Fortunately, there are ways to prevent these winter hazards from ever forming.

Prevention Tips

- Clear your gutters

- Insulate your attic

- Ensure proper ventilation

3. Fallen tree branches

Large tree branches that extend over a home could pose a problem in the winter. The added weight from ice can cause branches to break and fall on homes or fences.

If an icy branch does fall, your insurance policy’s dwelling coverage should cover necessary repairs to the home, while your other structures coverage will pay for things like a damaged fence or shed.

Trim your trees regularly to avoid the problem altogether. In fact, an insurer might deny a claim if it decides the damage is from a lack of maintenance over time.

4. House fires

House fires are a common cause of winter insurance claims, as people light candles and fireplaces. These tips can help prevent unwelcome flames.

- If you lose power, use flashlights instead of candles, and turn off all electric appliances.

- Keep Christmas trees hydrated so they don’t dry out and become fire hazards.

- Never use your kitchen stove to heat your home.

- Keep portable heating devices at least 3 feet away from anything flammable and unplug them while you sleep.

- Install a glass or metal screen in front of your fireplace, and have a professional chimney sweep clean it once a year.

Your home insurance will pay for fire damage as long as the fire wasn’t intentional. If you need to stay somewhere else because of smoke or reconstruction, your insurance policy’s loss of use coverage can help pay for hotel bills and additional living expenses. Keep any receipts in case your insurer needs a record of what you spent.

https://www.plymouthrock.com/resources/ice-dam-prevention

https://www.plymouthrock.com/resources/prevent-frozen-pipes

https://www.nerdwallet.com/article/insurance/winter-home-insurance-claims